Australia is known not only for devastating bushfires but also for flooding that is equally destructive. For property developers, this means understanding whether that perfect bit of land you’re close to acquiring lies within a flood zone.

Being in a flood zone doesn’t prevent any development, but it does require you to know the implications in terms of safety, insurance, and your bottom line. However, there are ways to design and build properties that can mitigate these risks. In this article we will explore how you can figure out if your property is in a flood zone and what this could mean for your next development project.

1. Understanding Flood Zones

Flood zones are geographical areas mapped out by the Australian government to indicate their risk of flooding. These zones are categorised based on the probability of a flood event occurring, but these categories can vary from State to State and even at a local council level. For example, Brisbane has the following categories for flood zones:

- High likelihood (5%)

- Medium likelihood (1%)

- Low likelihood (0.2%)

- Very low likelihood (0.05%)

The percentage represents the likelihood of flooding in the area in a year. In contrast, New South Wales (NSW) classifies zones into Low Flood Risk Precinct, Medium Flood Risk Precinct, and High Flood Risk Precinct. These classifications are further influenced by the source of the flooding, which could be storm tide/high tide flooding, river flooding, or overland flow flooding. When checking if a property is in a flood zone, be sure to also check the risk classification and what this means with the local council.

2. How to Determine If Your Property is in a Flood Zone

There are several ways in which you can check if a property lies within a flood zone. Each State and Territory has flood studies and flood risk information available for most locations, while many local councils also provide their own flood risk maps. The local council maps, where available, would usually include more detailed information. Another useful resource is the Australian Geoscience National Flood Risk Information Portal (AFRIP), which provides access to flood studies and historical reports.

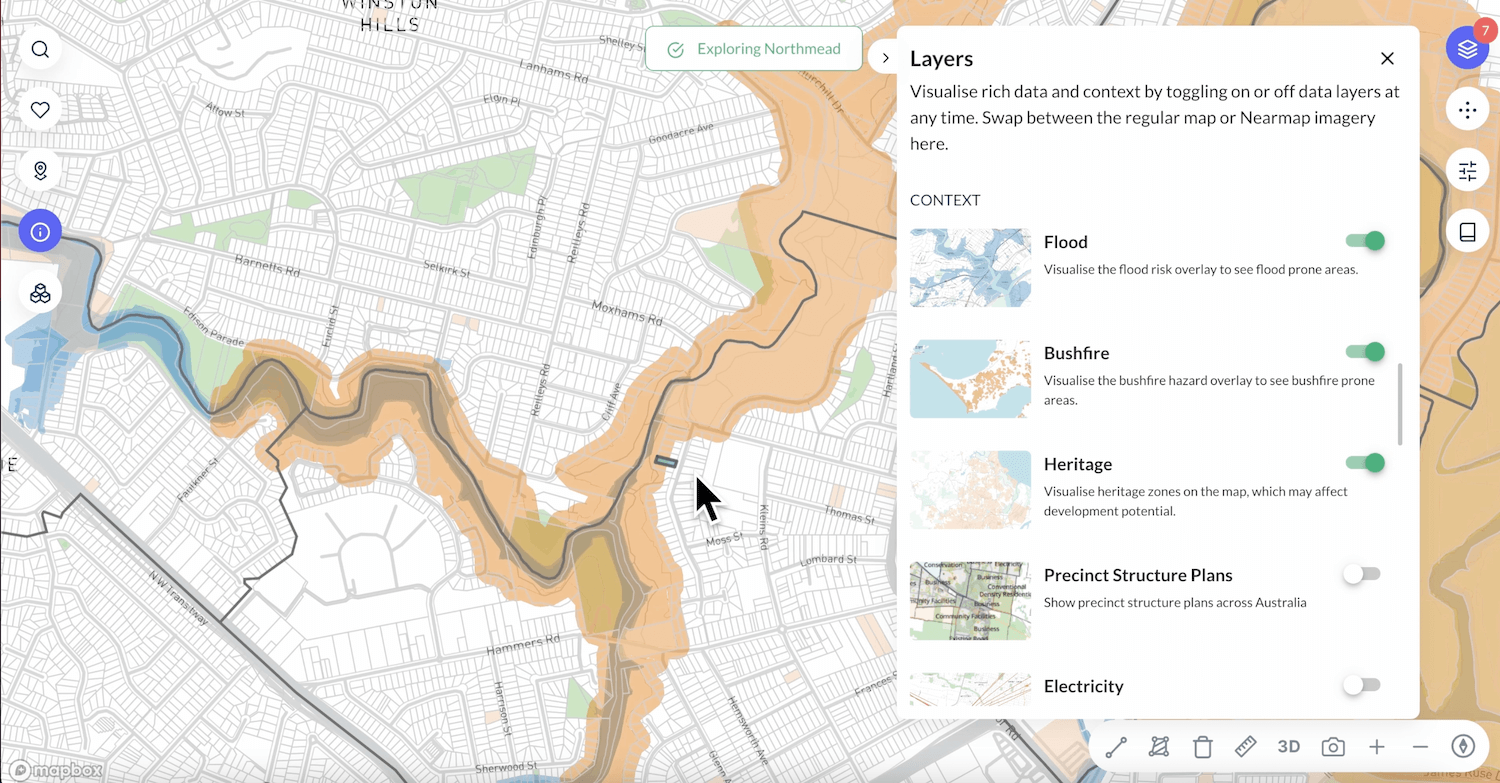

The Archistar property development platform makes it even easier to check the risk layers for your property, including flood zones. Instead of working with raw data, you get to see the flood risk for an area—and your property—as a map overlay. And you can augment this with other risk data layers, such as bushfires, so you can visually assess all the risks of your site instantly. This information can then be cross referenced with the local council’s flood risk classification system to better understand the real risk.

3. Implications of Building in a Flood Zone

As mentioned earlier, being in a flood zone doesn’t automatically prevent you from building a new development. However, you need to be aware of what this might mean for you and prospective tenants or future owners of the property.

- Insurance: The insurance premiums for properties in flood zones can be considerably higher due to the associated risks.

- Development Restrictions: To mitigate the risks associated with building in a flood zone, you might have to adhere to stricter construction regulations and specific design requirements, potentially affecting development costs.

- Resale Value: One of the bigger risks associated with developing properties in a flood zone is that it could deter buyers, especially if it is a high-risk flood zone. This could affect the resale value of the property.

4. Dealing with Flood Risks

You’re aware of your property being in a flood zone, know what the risk classification is, and have considered how developing it could affect you and potential owners. But there are a few other things you can do to mitigate the risks:

- Adjust the Design: There are various measures you can incorporate into your design that would lower the risk of flood damage. These could include building a raised or elevated structure, installing flood vents, and using flood-resistant materials wherever possible.

- Employ Landscaping Solutions: These could include grading to manage the flow of water, or creating flood barriers that form part of the natural landscaping.

- Consider Flood Insurance: It’s crucial to ensure your insurance includes flood cover. Be sure to understand any specific requirements and exclusions in your policy.

As a property developer, you’re in the business of turning land into valuable real estate. However, knowing the ins and outs of flood zones is critical to ensure the viability and longevity of your projects. Register for a free Archistar account today and take the guesswork out of your property research. This will allow you to quickly understand the risk profile of any property, including flood risks, enabling you to make informed decisions.

Add an extra line describing our flood zone data layer feature (e.g. how it’s very visual and can be added with other risk layers such as bushfire to assess the combined risk of a certain site).